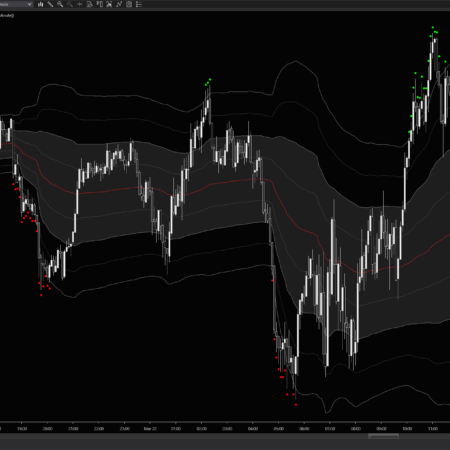

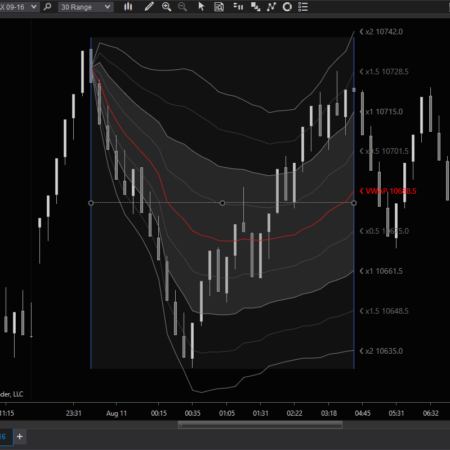

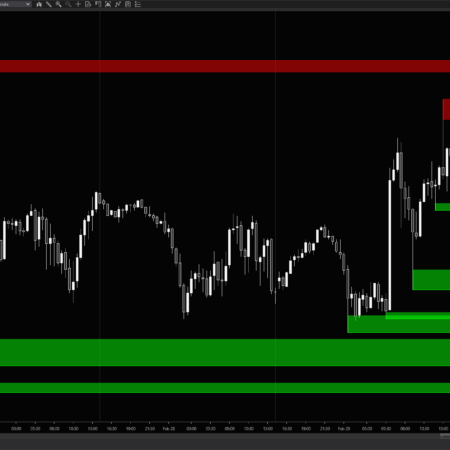

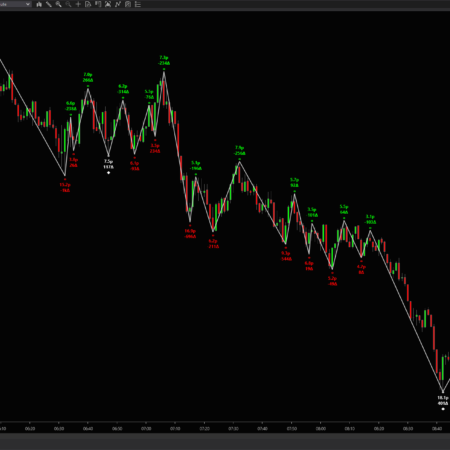

VWAP & Trend Analysis

Trend and swing (sometimes called rotations also) measurement are what the products in this category are all about.

Most folks experienced in intraday stock and futures trading are aware of the concept of VWAP, which stands for Volume-Weighted Average Price. VWAP is important for a couple of reasons. First, market makers’ buy and sell performance is often gauged relative to the day’s VWAP prices, so they tend to take action near it. Second, many accumulation and distribution algorithms are designed to trade at or near the VWAP – or as far away from it as is statistically probable to get the best prices.